A company’s stock is considered undervalued when BVPS is higher than a company’s market value or current stock price. If the BVPS increases, the stock is perceived as more valuable, and the price should increase. You will need the number of shares outstanding obtained from the income statement. You will only need to add the company’s market capitalization (easy to find on Google) and its price per share.

Real example: JP Morgan Chase & Company (NYSE: JPM)

This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth. This formula shows the net asset value available to common shareholders, excluding any preferred equity. The difference between a company’s total assets and total liabilities is its net asset value, government contracting for small business or the value remaining for equity shareholders. Book value per share is just one of the methods for comparison in valuing of a company. Enterprise value, or firm value, market value, market capitalization, and other methods may be used in different circumstances or compared to one another for contrast.

Is BVPS relevant for all types of companies?

- There are a number of other factors that you need to take into account when considering an investment.

- For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash.

- The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share.

- Significant differences between the book value per share and the market value per share arise due to the ways in which accounting principles classify certain transactions.

- In Particular, we can review if JPM stock became an exciting opportunity after the stock market crash.

However, for sectors like technology and pharmaceuticals, where intellectual property and ongoing research and development are crucial, BVPS can be misleading. Investors use BVPS to gauge whether a stock is trading below or above its intrinsic value.

Book value per share and tangible book value per share

Furthermore, you can use all of our cool financial calculators to improve your investments’ risk-reward profile. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business. This means that each share of the company would be worth $8 if the company got liquidated.

Everything You Need To Master Financial Modeling

If we put the annual values into our price-to-book ratio calculator, we will get a PB ratio of 1.9, which is way above 1.07. Those are two of the main questions we ask while formulating an investment thesis. After we have decided which company to buy, it is important to see that it is not overvalued. When we mentioned that book value represents assets’ economic value if we pay all financial claims, we did not talk about non-physical assets. The following image shows Coca-Cola’s “Equity Attributable to Shareowners” line at the bottom of its Shareowners’ Equity section. It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment.

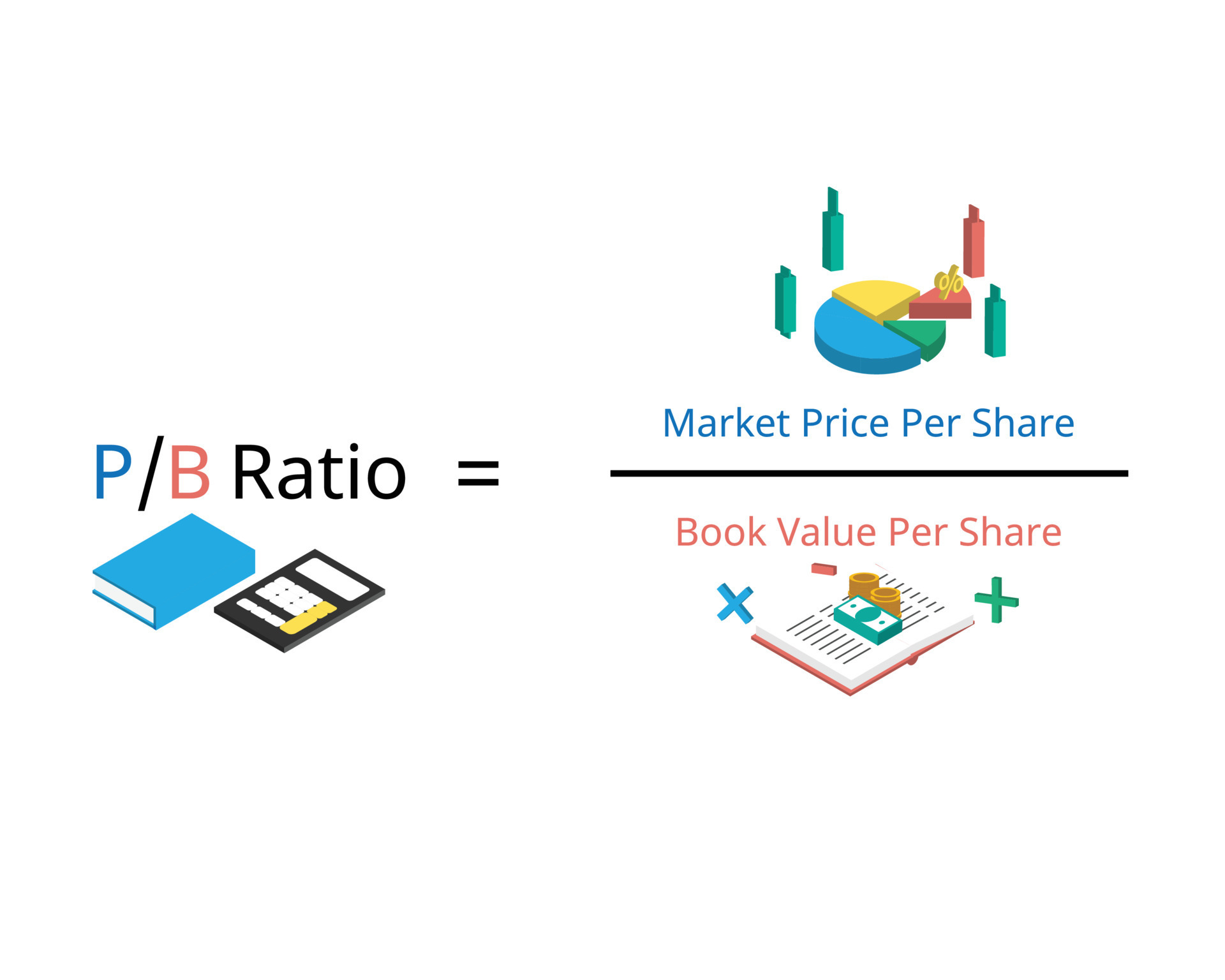

If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases. The price to book ratio calculator (also called price to book value or PB ratio) is a fast tool that can show us if a company’s stock is undervalued. In this article, we will first review what is the book value of equity because that will allow us to understand book value per share and tangible book value per share. Finally, we will see how to calculate the price-to-book value ratio and apply it to a real example. Now, let’s say that XYZ Company has total equity of $500,000 and 2,000,000 shares outstanding.

U.S. generally accepted accounting principles (GAAP) require marketing costs to be expensed immediately, reducing the book value per share. However, if advertising efforts enhance the image of a company’s products, the company can charge premium prices and create brand value. Market demand may increase the stock price, which results in a large divergence between the market and book values per share.

Preferred stock is usually excluded from the calculation because preferred stockholders have a higher claim on assets in case of liquidation. A P/B ratio of 1.0 indicates that the market price of a share of stock is exactly equal to its book value. For value investors, this may signal a good buy since the market price generally carries some premium over book value. There is a difference between outstanding and issued shares, but some companies might refer to outstanding common shares as issued shares in their reports. The next assumption states that the weighted average of common shares outstanding is 1.4bn. If a company’s share price falls below its BVPS, a corporate raider could make a risk-free profit by buying the company and liquidating it.

On the balance sheet’s assets side, accountants record goodwill and other intangible assets, such as the value of patents, licenses, and brands. Those are written with a monetary value because they have the potential to influence the revenues. While the return on equity formula (ROE) includes overall equity, it is always worth knowing the intangible assets’ impact in that process. Book value per share (BVPS) is a measure of value of a company’s common share based on book value of the shareholders’ equity of the company. It is the amount that shareholders would receive if the company dissolves, realizes cash equal to the book value of its assets and pays liabilities at their book value.

For example, if a company has a total asset balance of $40mm and liabilities of $25mm, then the book value of equity (BVE) is $15mm. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from the latest financial report (e.g. 10-K, 10-Q). Therefore, the amount of cash remaining once all outstanding liabilities are paid off is captured by the book value of equity. Therefore, the book value per share (BVPS) is a company’s net asset value expressed on a per-share basis. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.